5 Bullet Friday...Do You Really Need to "Buy Now Before Rates Go Down?"

Welcome back Sudbury! 👋

I’m sorry I took a few weeks off from my weekly email. I took an awesome break with the family and kids to hang out and really just enjoy the family. We spent time at the rinks (indoor and outdoor), time on the slopes (despite mostly artificial snow), and a ton of relaxing time with family and friends. I hope your Christmas break was just as relaxing as mine!

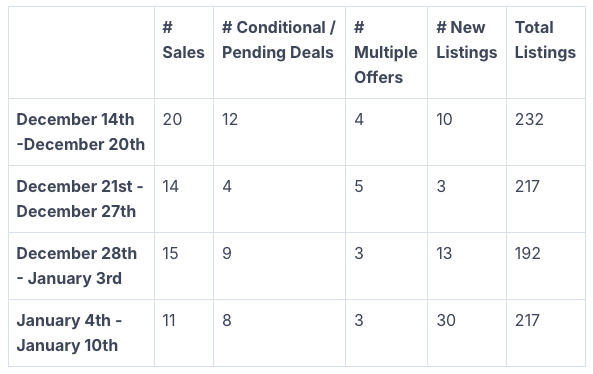

Take a peak at the numbers from the last few weeks!

Here are my 5 takeaways this week:

📉The winter season lull is upon us, and we saw total listings drop back below 200 for the first time since May of last year. The seasonality we typically see play out over the holidays is when we hit the lowest number of total listings for the whole year. A year ago, that number dropped to 148 listings, and two years ago it got as low as 49 listings. So as we just dipped below 200 for what is likely the low # of listings for the year, there is much more homes available for sale than what is typical for this time of year. The reason? People feel the need to sell more now than they have in the past, financially they are struggling, and that’s why you see people keep their home on the market over the holidays.

💰Realtors are pushing the narrative ‘buy now before rates go down and house prices spike.’ This is the messaging they are chatting about with their buyers and the message they are repeating on socials. This has historically been true that when rates come down, we have seen prices go up as buyer confidence increases. The big caveat that needs to be taken into consideration is that it costs a lot of money to finance the debt on purchases still. The reason the Bank of Canada has been lowering the rates is they have access to a ton of financial data for the country and they are seeing that Canadians are in trouble. Could prices go up when rates come down? Sure they could. History shows us that there is a correlation when rates go down prices go up. Will that happen this time? Possibly, but I do think the heavy debt load people are facing needs to be considered.

📈I always enjoy chatting with my mortgage broker friends to get a pulse for what is happening in their world. I believe that the number of new pre-approvals is a leading indicator to the market gaining speed. Locally, I’m hearing that there is a small uptick in activity, something that traditionally happens after the holiday season. But when we step back and take a bigger view on what’s happening down south, it seems like that marketplace is seeing a huge uptick in activity. It will be interesting to see trends play out down there as we are usually a few months behind the activity that happens down South.

🏡When is the ‘right time’ to list your home this year? This is a tough question, and one with multiple answers. We are actively listing homes now in the current marketplace. I do think that the wrong time to list was during or just before the holidays, so there will likely be a rush to market of all those more motivated sellers that want to get their home on the market. One trend I’ve heard chatting with other agent friends is that a lot of sellers are trying to be ‘early’ to market this spring; traditionally that’s the time that the majority of the buyers aim to be on the market. The buyers get the itch to search for a home and those that want to wait until the snow is gone to be out touring homes and eventually moving their furniture are targeting as the ideal time to be a home shopper. Our typical advice is to aim for the May flowers that come after the April showers, but we may see this timeline get pushed ahead by a few weeks this year if buyers are acting earlier. From a local perspective, it can be some crumby weather in April with snow melting, muddy yards and the hidden dog droppings from the winter showing up. Despite that, I think this is a trend we will see play out this year; an earlier start to the spring market.

📊I’ve given my thoughts on what I see playing out in the market in a lot of past reports, but I’m going to summarize it quickly again for those who are new to reading my weekly 5 thoughts. First time home buyers have wrapped their mind around prices and values, even with current rates. That’s led to a lot of first time home buyers jumping into the market (price 325-425K); the majority of these homes that are for sale are not buyers that have outgrown their current homes and are looking to get something bigger, but they are seniors downsizing to assisted living homes (huge volumes of new units have come available in last few months), or investors who bought during COVID, tried the rental thing, didn’t like it and are seeing that they are losing money with current mortgage prices so they are dumping the homes. This has led to a healthy market for the ‘entry level home’. That may change in price based on location (southend sub-500k vs New Sudbury 400-ish). This has led to one segment of the market being strong (first time home prices), while homes that are targeted to ‘step-up’ buyers or luxury homes are a very tough sell in the current market. I think as consumer confidence comes back (with rates coming down) we will see a pick up in this market; but at the current time realize that the market can be strong and weak at the same time depending on the home you have for sale.

That’s it for this week, let's connect next Friday for another Sudbury Market update!

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.