5 Bullet Friday...The Lifeblood of the Market - First Time Buyer Homes

Welcome back Sudbury! 👋

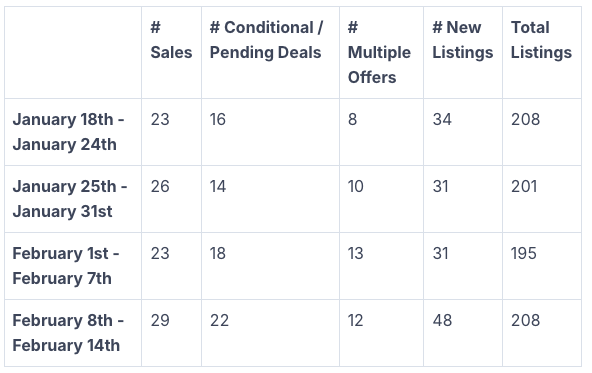

Take a peak at the numbers from the last few weeks!

Here are my 5 takeaways this week:

📈This week we saw the listings start to pick up, and in a big way. We had a 35% increase in new listings this week on the market, which led to a decent increase in total active listings available as well. Agents have been on Instagram and on the phones with their clients for the last few weeks saying the buyers are out there. It is a good time to get your home on the market, and sellers clearly got the message over the last week. Will this trend continue is the big unknown.

🏡I am seeing a lot of listings that failed to sell in December of last year come back on the market. The big question with this strategy is, will the buyers jump at the places now that they were avoiding last year? If they do, it would support the theory that the market continues to improve with the belief that interest rates are done their increases and decreases should be in the near future (still not 100% confident in this assumption). Or will these listings sit as owners look at future price reductions to get them sold? There seems to be a divide between listings that are ‘sale-able’ listings and some that are just overpriced pipe-dreams for some sellers. At any given time, we may be looking at 20% of the listings as well priced and good options. Another 50% may be reasonably priced, not showing great/not properly staged, buyers may eventually see value, especially if the market continues to improve in prices; and 30% is just over priced, pipe-dreams for some sellers.

💰We saw some big places sell or go pending in the last 7 days. None bigger than the 24 unit apartment building in New Sudbury that was built just a few years ago. The place listed on Cardinal just under 9Million was built in 2017 and features mostly 2 bedroom units that show modern and beautiful. The selling price was close to a million under the list price but at just under 8 Million, still a big purchase. Apparently it was bought by individuals as well, not a big REIT or corporation. This supports the idea that there is a lot of money sitting on the sidelines looking for opportunities, and people aren’t afraid to jump on projects they see good value. I think a sale like this is really good overall news and hopefully a leading indicator that we are headed towards stronger demand in the market overall.

📊The MLS home price index is a public data source that shows a 3 month rolling average of home price sales for specific areas. I love this tool and encourage all my agents and the public to follow it as a good indication of which way the market is ebbing and flowing. For the first time in 6 months, we have seen this index turn positive. It was a small increase, going from 422k to 428k; but a positive turn nonetheless. This feels like where the market as a whole has trended. It feels like consumer confidence has turned and things will likely get more expensive. Garth Turner, my favourite daily blogger, called the bottom of the market in January; he takes a bigger picture view that includes Toronto and Vancouver, but still relevant for what we are seeing play out here locally.

💵For those who follow my weekly posts, you’ve seen my comments that the First Time Home Buyer price range has been the lifeblood of the market lately. We had ‘price discovery’ happen mid-last year, when buyers who were holding off with uncertain interest rates and prices that seemed to be dropping started jumping in after they felt like prices and payments were good value. Most of the homes that were selling weren’t buyers that were ‘climbing the property ladder’, stepping up into bigger homes. Instead, they were sellers who were getting out of the market and into senior housing after the big boom of available listings had recently come to market. That combined with investors who bought during the boom, over-extended and with the rise in rates, they are seeing opportunities to cash out of the market altogether. This is a positive for sellers in the 350-500k range, but hasn’t improved the market in the ‘step-up’ home range (500-900k). For a real estate market to be healthy, we need to see people climb that ‘property-ladder’, and that hasn’t happened much in the last few months. We are starting to see signs of this market come back; we have had 15 sales in that price range in the first half of February, which is more than we had in all of January (13 sales total in January). With the thought that rates are coming down in the future (something I don’t entirely agree with), buyers seem to have more confidence to jump into bigger homes, and with it, bigger loans and payments.

That’s it for this week, let's connect next Friday for another Sudbury Market update!

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.