5 Bullet Friday...The Luxury Market in Sudbury 💰

Welcome back Sudbury! 👋

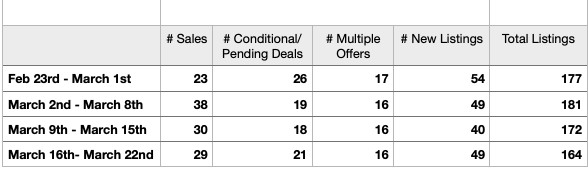

Take a peak at the numbers from the last few weeks!

Here are my 5 takeaways this week:

🏡Sales are pretty stable, averaging just over 4 homes a day selling over the last few weeks. In addition to that, we're seeing a strong number of conditional deals, which means that buyers are able to shop and get offers accepted with conditions. Even new listings jumped back this week after last week's anomaly of 49. The strange part of this is that total listings continue to drop. At 164 homes, this brings us back to the number of listings we saw the first week of January this year. I’ve made the point for a number of weeks now that for the market to cool down for buyers, we need to hit 225+ listings available for sale; and we are trending in the wrong direction.

💰We’ve chatted often about the value of a million bucks in real estate now versus what it was in the past. With the addition of the 4.5M mansion overlooking Long Lake (rumours had it that Ryan Reynolds and Blake Lively would use this as a rental house when they started in Sudbury) that came back on the market, after selling last year; it got me thinking about the “Luxury Market” in Sudbury. I did a quick search and in the Greater City there are 20 residential homes priced at a Million+; if we include the listings that are just shy of a million, that number goes to 25 listings. 25 out of 165 total listings means 15% of the market is million-dollar homes. On the flip side, if I take that same range (just under a million $) we have seen 11 sales so far in 2023; 11 sales out of 274 sales this year so far shows us these sales account for 4% of the market. We can also project out that if we see 11 of these $M+ homes sell in each of the quarters this year, that would bring to about half of the sales we saw happen in the same price range in 2022. The market could be back but the ‘luxury’ type buyer may be fewer and hard to come by this year. We had some buyers looking at these luxury homes this week, and it was interesting to see how many ‘off-market’ opportunities are available when you chat with some of the other agents in town that have clients who are preparing or are potential sellers.

📈The Fed (the US version of the Bank of Canada) increased rates by .25% at their last meeting. With the thought of the increase in banking failures throughout the US, a lot of people thought they were going to pause or even reduce the rates at the last meeting. This is in comparison to the Bank of Canada who have paused rate increases now for 2 straight meetings (and it seems like this will continue to be the trend). When the Fed increases rates and the Bank of Canada doesn’t, it typically will decrease the value of the Canadian Dollar (in comparison to the US); which is a negative, especially since they are our biggest trading partner and it will cost us more to buy the same goods from the US (inflation). The difference here is the Bank of Canada started with massive hikes at their first few meetings, where the Fed took a much slower approach to increasing the lending rates (which directly impacts interest rates) and they haven’t been able to cool inflation to the same extent we have done in Canada. With the latest numbers on inflation in Canada that came out this was on full display. Garth Turner, who I often talk about in my Friday thoughts, had a great summary a couple of days ago. We see that Canada is doing a better job of tackling inflation than most of the other big countries around the world. We aren’t back to 2% target rate of inflation, and the cost of groceries are continuing to go up based on the last numbers, but this is a positive sign that we are in a better position than the rest of the world when it comes to our financial future.

👥One million people. 2.7% population growth in Canada which is the biggest bump in our population since the 1950’s. I love that we are an open country and our current birth rate isn’t strong enough to even support our current population; we need the additional immigration, and we are a country that can handle it. The growth is sure to play out in lots of different ways, including the job market and the housing market as we shift the makeup of our country. The biggest surprise that followed the immigration was how big of a surprise the immigration was to the federal government. Initially, we projected less than a 500k population growth, then that was revised to 800,000 people when they saw the increase in foreign students and temporary workers, then the real data came out from StatsCan and it showed it was a million people that came into the country. The easiest bandaid solution to our economy and the housing market is to bring in a massive amount of people, and not offer a solution to the additional homes and apartments that are required to house the additional people coming into the country. Canada continues to be an amazing place to live, and the envy of a lot of the world. With our relatively low population, we have a lot of room for future growth.

🤔Last reflection is where does the market go from here…. All real estate is local, and I want to focus on local market to Sudbury with my predictions on where the market goes. Buyer activity is extremely strong, but I still believe we are going to see a lot fewer houses sell in 23’ than 22’ because of the massive increase in the cost of debt that we have experienced. On the flip side, I think out of that additional immigration, the idea that interest rates have levelled off and how affordable Sudbury continues to be on the national and global level; these are all reasons we could see things boom locally. I chatted with the team on the average price of a house in Sudbury (think a New Sudbury brick bungalow); these are currently selling in the 425k - 450k price range. If we project out a year from now, what is the average home worth? We saw it peak at 520k - that was with 2% mortgages that acted as gasoline on an already frenzied real estate market. Half of the team thought we would see prices in the mid-high 400k, and my personal thought is that we will see prices stay flat. It will take some time to adjust to the increased costs of the higher debt payments, even despite the additional population growth. I think debt payments from credit cards to car payments will have a long tail effect on working its way through the market. As stated before, I don’t think we go down any further; buyers have shown us that they are ok jumping into the market with the current prices, and that provides some stability and a floor for market activity. At the same time, don’t listen to a TikTok realtor telling you if you don’t buy today you won’t be able to afford a house tomorrow.

Those are my thoughts on the market this week. Thanks for tuning in Sudbury, we’ll chat next week!

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.